Book value gets a lot of attention these days - perhaps because it's such an easy number to find. You see it reported everywhere. With current technology, u can google and it can generate a number of stocks that traded below its book value. In theory, u just buy a stock that has a higher book value versus its price. Example, book value per share RM8.00 versus stock price RM4.00. Before I start going into book value, let's us understand what is book value. The formula is pretty simple:

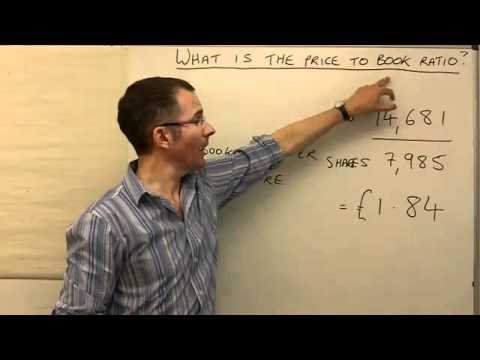

How it is used among investors? It compare share price against book value per share. The ratio measures how far share price against its book value. Assuming A stock priced at RM15.00 versus its book value RM3.00 per share. It is said that the stock is traded at market 5 times against its book value. It may be considered at Overvalued stock, not a buy criteria. or the other way around, stock that is sell 0.5 time than its book value, can be considered as undervalued stock. Similarly, the NTA (net tangible asset) which has similar behavior.

The drawback of this method is that, the stated book value often bears little relationship to the actual worth of the company. It sometimes doesn't reflect the true value (be it understates or overstates). For example, Penn Central had a book value of more than USD60.00 per share when it went bankrupt. In 1976, Alan Wood Steel had a stated book value of USD32 million (USD40 per share). However, the company filed for Chapter 11 Bankruptcy 6 months later (similar like Pn17). The problem was that its steel-making facility, worth perhaps USD30 million on paper, was ineptly planned and certain operational flaws rendered it practically useless. TO pay off some of the debt, the steel-plate mill was sold to Lukens Corp. at around USD5 million and the rest of the plant was presumably sold for scrap.

A textile company may have a warehouse full of fabric that nobody wants with book value USD4 a yard. In reality, they couldn't give the stuff away for 10 cents. There's another unwritten rule here, the closer you get to the a finished product, the less predictable the resale value. You know how much cotton is worth but who can be sure about,an orange cotton shirt? You know what you can get for a bar of metal but what is it worth as a floor lamp.

A few decades ago, Warren Buffett decided to shut down the New Bedford textile plant that was one of his earliest acquisitions. Management hoped to get something out of selling the loom machinery which has a book value of USD866,000. But at a public auction, looms that were purchased for USD5,000 each years back, now were sold at USD26. What was reported as book value of USD866,00 only brought in USD163,000 in actual cash.

Overvalued assets on the left side of the balance sheet are especially looked very suspicious when there's a lot of debt on the right side. A company may reported RM400 million in assets and RM300 million in debts, resulting in a positive book value of RM100 million. The debt part is a real number. but assets of RM400 million may be worth at RM200 million in a bankruptcy sale or auction, then the actual book value is a negative RM100 million. now, it has become a worthless company.

A piece of advice, when you buy a stock just because its book value, drill down the detail of what those values really are.

For more clarity, you may want to evaluate Warren Buffett recent acquisition: (1)Exxon Mobil (2) Heinz (3)IBM or even its current shareholding like Coca Cola (in Berkshire Hathaway).

Is he buying stock that value higher than its book value (5 times than price to book ratio) or lower than its book value (1 time than price to book ratio). Or, why isn't he selling Coca Cola if it is traded higher than its book value?

In summary, just be careful using a book value, or it can be a value trap!